Companies can also manipulate their reported earnings by adjusting reserves and provisions. By increasing or decreasing these accounts, companies can smooth out their income over time. For example, a company may increase its provision for bad debts in a good year to offset potential losses in the future.

Financial Literacy Matters: Here’s How to Boost Yours

Then in a year with low profits, the company will reduce the allowance for doubtful accounts and greatly reduce bad debt expense. Moreover, implementing strong internal controls, independent audits, and fostering an ethical financial management culture within the organization can further help prevent such practices. One way companies can smooth their income is by manipulating the timing of revenue recognition. They may choose to recognize revenue earlier or later than usual, depending on their desired earnings pattern.

Legality and Ethics:

- For example, in a year of low earnings, a company might eliminate jobs, defer maintenance or reduce R&D spending.

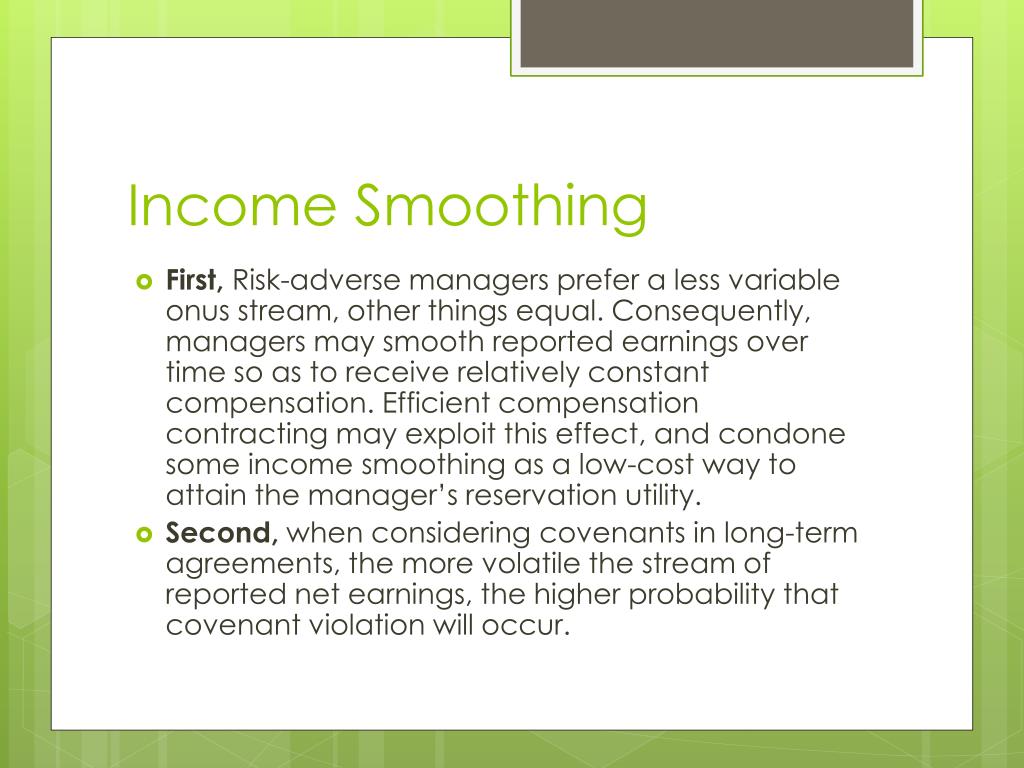

- Income smoothing involves strategically adjusting a company’s net income to create a more consistent and stable pattern of earnings over various reporting periods.

- While it can appeal to investors, excessive income smoothing raises ethical concerns and may mislead stakeholders about a company’s proper financial health.

- Transparency and good communication with stakeholders are crucial in ensuring that income smoothing is seen as a legitimate financial management technique.

- For our purposes, income smoothing refers to a range of accounting practices used to reduce the variability in corporate earnings from one period to the next.

For example, a company may delay recognizing revenue from a large sale until the next reporting period to boost future earnings. Income smoothing is a strategy that helps businesses navigate income fluctuations and achieve financial stability. By implementing the appropriate methods and techniques, companies can present a more consistent and reliable financial performance. However, it is essential for businesses to adhere to legal and ethical boundaries and maintain transparency in their financial reporting. Income smoothing, also known as profit smoothing, aims to reduce the volatility of a company’s reported earnings by mitigating large fluctuations.

Case Study: Enron

The problem with discretionary action is that it is easy to see and thus flags to investors that a firm is in trouble or that management is not doing a good job at maximizing profit. Recent academic literature suggests that firms with greater earnings volatility deliver an informational advantage to informed versus uninformed investors. The accounting principle that determines the specific conditions under which income becomes realized as revenue.

In a year of high profits, for example, a company might increase its allowance for doubtful accounts with an increased bad debts expense. In a tough year, the company might income smoothing describes the concept that reduce the allowance for doubtful accounts to reduce bad debt expense. Or, a company might alter the way it provisions for future option payments to its employees.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

While it may seem like a harmless strategy, income smoothing can have significant implications for investors, regulators, and the overall stability of the financial system. Enron used off-balance-sheet entities and complex accounting techniques to manipulate its reported earnings and hide its true financial condition. The company created special purpose entities (SPEs) to keep debt off its balance sheet and inflate its earnings.

Of course, the assets created by capitalization needed to be depreciated but this was a great way of deferring the costs of failed investments. An accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged. Following discussions with industry bodies and a thorough review of shareholder experience, the company concluded that discontinuing income smoothing is in the best interest of shareholders. Future payments will now be based on accrued income from the respective share class during the payment period, with no income being held back. Depending on the country, companies pay a progressive corporate tax rate; meaning that the higher the income earned, the higher the taxes paid. To avoid this, companies may increase provisions set aside for losses or increase donations to charities; both of which would provide tax benefits.

Management typically engages in income smoothing to increase earnings in periods that would otherwise have unusually low earnings. The actions taken to engage in income smoothing are not always illegal; in some cases, the leeway allowed in the accounting standards allows management to defer or accelerate certain items. In other cases, the accounting standards are clearly being sidestepped in an illegal manner in order to engage in income smoothing. Income smoothing is a common practice used by businesses to reduce the variability of earnings and create a more stable financial picture over time. While it is legal when done ethically and in compliance with accounting standards, businesses must exercise caution to avoid engaging in fraudulent practices.