Utilities are another capital-intensive business that cant operate without large amounts of capital. Short-term debt doesnt have as big of an impact as long-term debt does on the debt-to-equity ratio, as short-term debt obligations can be managed and recorded more easily. Long-term debt accounts are much larger and offer a more significant impact. Debt-to-equity ratios are not a one-size-fits-all formula and are dependant on a variety of factors. When considering whats a safe debt-to-equity ratio, its important to take into consideration the nature of the business as well as the industry.

Total Liabilities

They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations. In other words, you’ll divide your total liabilities by your total equity. If a company has a ratio of 1.25, it uses $1.25 in debt financing for every $1 of debt financing.

Examples of the Debt Ratio

Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk. In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations.

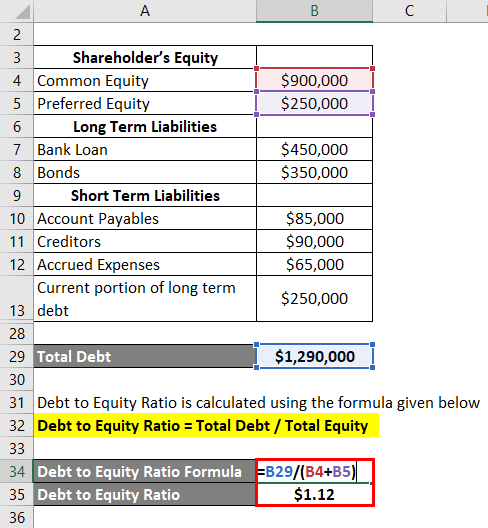

How to Calculate the D/E Ratio in Excel

- (Sometimes, it could mean both.) If that’s the case for you, understanding your debt-to-equity ratio is crucial to understanding your company’s financial position.

- She has specialized in financial advice for small business owners for almost a decade.

- As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply.

- By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario.

- When calculating the debt-to-equity ratio, we look at the companys balance sheet, which is the financial statement of what the company owes and owns.

- T-bills are subject to price change and availability – yield is subject to change.

The debt and equity components come from the right side of the firm’s balance sheet. Long-term debt includes mortgages, long-term leases, and other long-term loans. The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account.

While taking on debt can lead to higher returns in the short term, it also increases the company’s financial risk. This is because the company must pay back the debt regardless of its financial performance. If the company fails to generate enough revenue to cover its debt obligations, it could lead to financial distress or even bankruptcy. The D/E ratio is a powerful indicator of a company’s financial stability and risk profile.

The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks. At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance what is and how does an accounting department structure work on debt. A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations. This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts.

Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. That can happen when you have no debt on your balance sheet, and more than zero investment capital. This is, theoretically, an incredible financial position to be in—but most business owners aren’t. Don’t feel bad if you have some debt on your books, just keep your debt-to-equity ratio from creeping up. Options transactions are often complex, and investors can rapidly lose the entire amount of their investment or more in a short period of time.

When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. It’s also important to note that interest rate trends over time affect borrowing decisions, as low rates make debt financing more attractive. You can find the inputs you need for this calculation on the company’s balance sheet.

In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities. A debt-to-equity-ratio that’s high compared to others in a company’s given industry may indicate that that company is overleveraged and in a precarious position. Investors may want to shy away from companies that are overloaded on debt. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. Quick assets are those most liquid current assets that can quickly be converted into cash.

Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits. A company with a D/E ratio that exceeds its industry average might be unappealing to lenders or investors turned off by the risk. As well, companies with D/E ratios lower than their industry average might be seen as favorable to lenders and investors. The numerator in above formula consists of total current and long-term liabilities and the denominator consists of total stockholders’ equity, including preferred stock, if any. Both the elements of the formula can be obtained from company’s balance sheet.